Notre Mission

Votre Bien-Être

Hypnose Thérapeutique et Intégrative

Médecine Traditionnelle Chinoise

Ostéopathie

Bio-kinésiologie

PNL

Psychologie

Feng-Shui Traditionnel

Coaching

Techniques Énergétiques

Chrysalys rassemble des praticiens dévoués dans leurs disciplines qui se démarquent par leurs qualités humaines.

Toutes nos pratiques sont focalisées sur le développement personnel, le bien-être physique et mental.

Rencontrez nos thérapeutes

Vous trouverez ci-dessous les intervenants qui exercent actuellement chez nous.

Ouvrez la fiche de contact du praticien qui vous intéresse pour accéder à ses coordonnées.

Roland

Immordino

Hypnose Ericksonienne & Intégrative | Coaching | PNL

Mireille

Immordino

Astrologie chinoise - Tarologie - Feng Shui Traditionnel

Hervé

Robin

Médecine Chinoise Acupuncture

Anaïs

Magnino

Ostéopathe

Acupressure

Véronique

Espérance

Romana's Pilates

Stretching & Renforcement Postural

Aurélie

Milicic

Praticienne Reiki

Hypnose Ericksonienne

Guy

Jenna

Psychologue

Clinicien

Yannick

Bourdarel

Sophrologue

Psychologue du travail

Ombeline

Ferrand

Yoga

Vinyasa

Yamina

Mouloudj

Psychothérapeute

Thérapie de couple

EMDR Sexologie

Transgénérationnels

Laetitia

Rousset

Radiesthésiste

Amalia

BEYER

Professeur de PowHer Yoga - Vinyasa - Yin

Massage thaïlandais traditionnel

Soin de la Femme Rebozo

Andros

Alfonso

Salsa Cubaine

Danseur chorégraphe

Pauline

Roux

Psychopraticienne & Chromothérapeute Praticienne Bilan de compétences

CECILE

TRUC

Psychopathologie, Naturopathie

Iridologie

Hypnose Ericksonienne

Psychologie Clinique

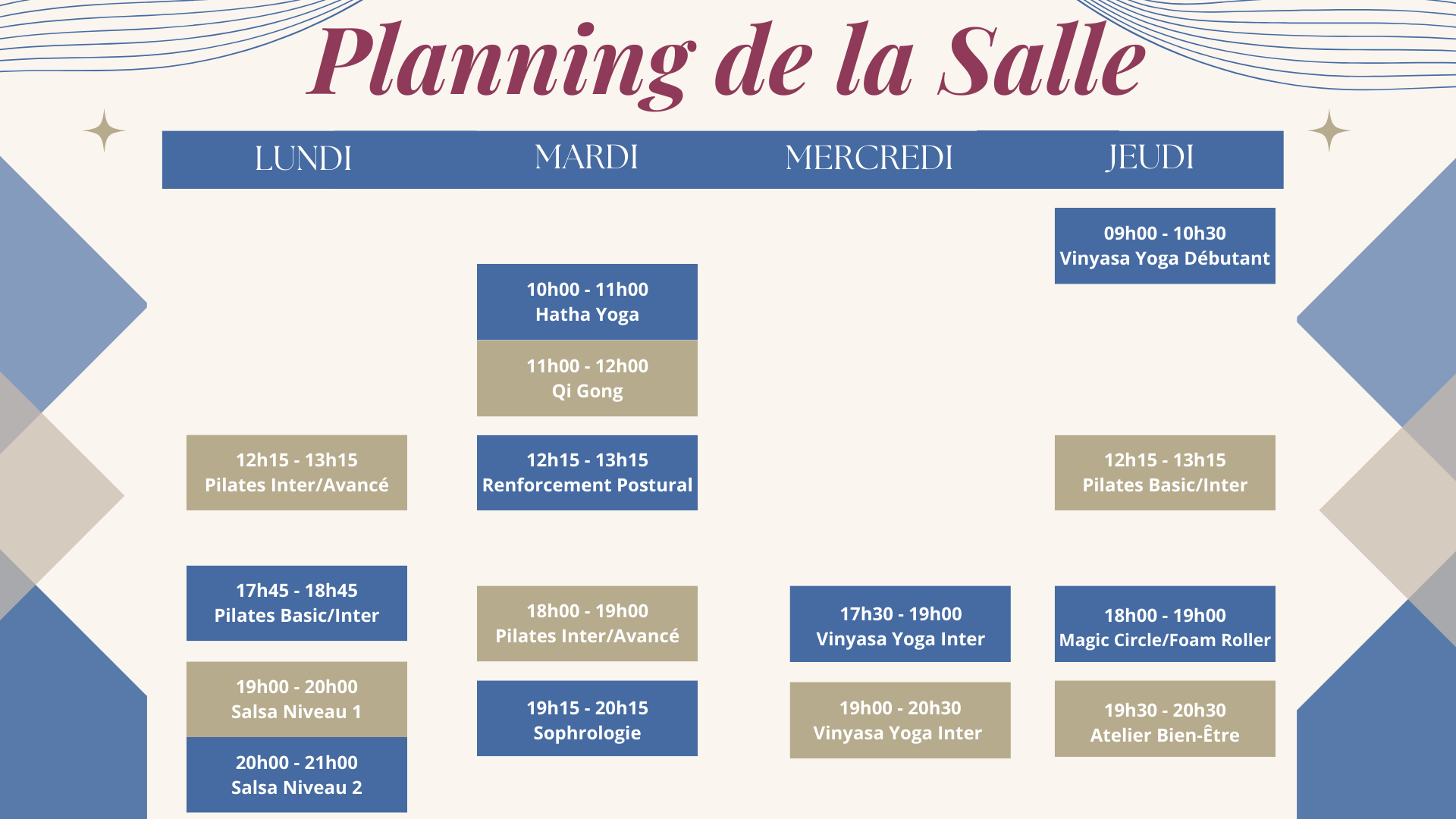

Évènements

Retrouvez ici les conférences, ateliers et séminaires proposés par notre centre de bien-être et de développement personnel.

Contactez-nous si vous souhaitez animer un évènement à l’espace Chrysalys.

7 et 8 Octobre 2023 | Formation Yoga du Rire – Stéphane POISSON

Formation Yoga du Rire

30 Septembre 2023 | « Je prends ma vie en main » – Pascale RICHARD

Mieux se connaitre avec la numérologie

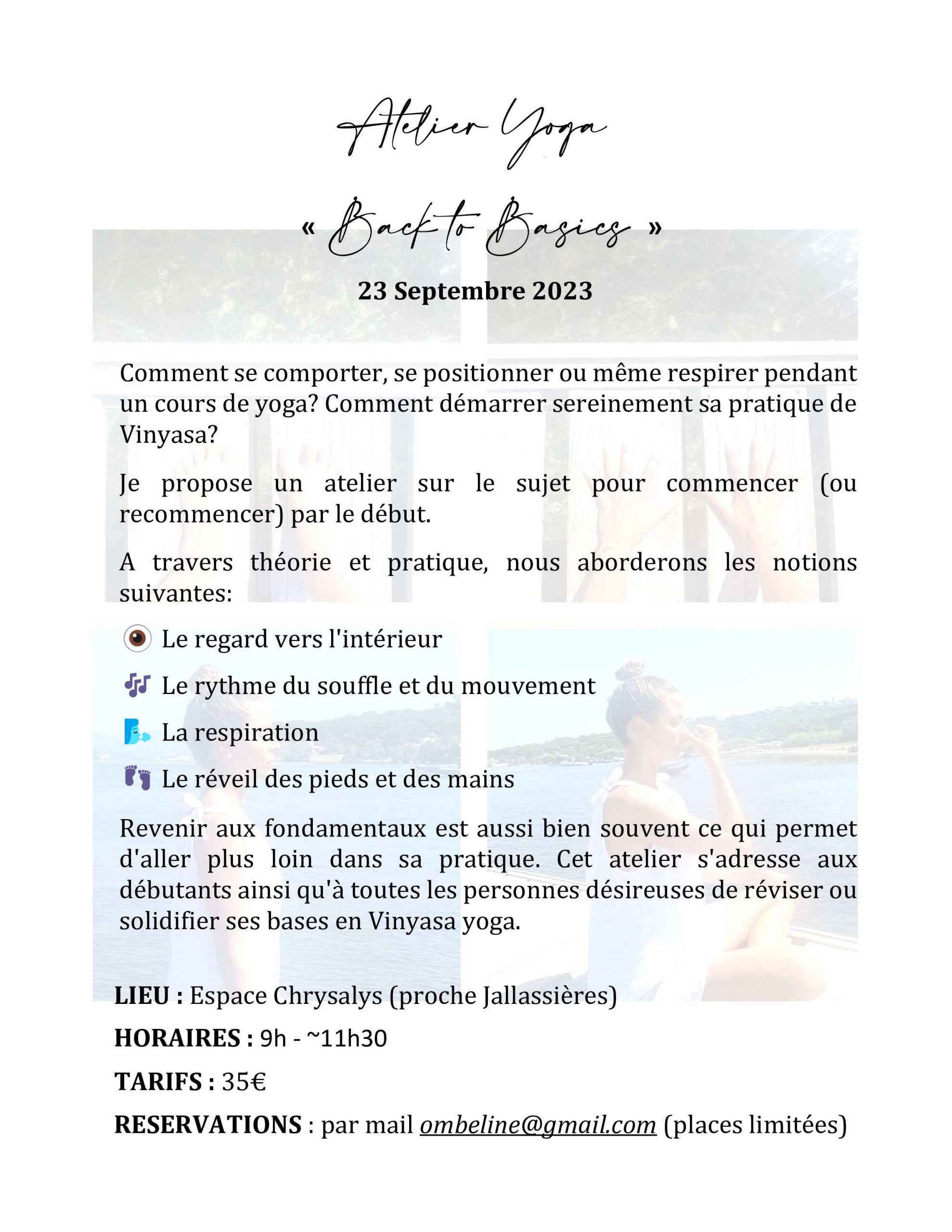

23 Septembre 2023 | Atelier Yoga « Back to Basics » avec Ombeline FERRAND

Démarrer sa pratique de Vinyasa

Avis Clients

Contact & Accès

Pour tout renseignement, veuillez nous contacter par téléphone, par email ou via notre formulaire. Si vous souhaitez prendre rendez-vous avec un de nos intervenants, merci de les contacter directement 🙂

Téléphone : 06 07 29 35 28

Adresse : Impasse OPALINE, 2090 A Route de Loqui

Bat. A – 2ème étage – 13510 Éguilles

Du Lundi au Samedi, 09:00 – 19:00